End of the Road…

I wrote this in response to a friend complaining about Greek irresponsibility.

The other angle is the corruption of the banking system as it’s currently structured and the complicity of the EU so called creditors i.e. Merkel, (where Germany is the main beneficiary of the Euro) in conjunction with the ECB’s Draghi and Lagarde of the IMF.

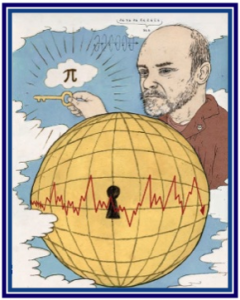

There is no tangible value backing ‘money’ in the current fiat banking system. Banks create money when they make loans; all money is loaned into existence. This is confirmed in the BofE Quarterly bulletin from just over a year ago here.

This is done at no material cost to the bank, and yet the payment of the interest requires the investment of intellectual or physical labour of the borrower, which is a material cost. Furthermore, the charging of interest (for risk ?) where the bank can suffer no loss and is not being temporarily deprived of the funds extended as credit (since they didn’t exist prior to the inception of the ‘loan’) means that in reality the entire transaction is utterly inequitable. Fraudulent even, notwithstanding its being legally sanctioned.

At the time the ‘money’ is created, they don’t also create the ‘money’ required to pay the interest, so bankruptcies are an absolute inevitability. It’s musical chairs.

Most of the bailout money ‘given to Greece’ has actually gone to the banks because these loans count as assets on the bank balance sheets and if they get wiped out, bank capital will get reduced, which would cause a deflationary spiral and collapse the entire Eurozone banking system. When you consider that the derivatives exposure of Deutsche Bank is $75 trillion, a 20x multiple of German GDP, this will probably happen anyway, eventually. It’s just a bubble in search of a pin.

Bank balance sheet write downs will be the result of any hard default, whereas QE on the other hand is the way to conduct a silent default and is avidly being pursued by the ECB. So default is not a moral issue for them. But basically the EU has attempted to sacrifice the Greek people in order to keep the banking system afloat and allow them to conduct their own soft default while continuing to extract the output of Greek labour to pay the banker’s salaries. OK, I know that’s a bit of a crude characterisation of the situation.

This entire situation is entirely of the making of the collusion of a large number of players, not least the ECB. By preventing a Greek currency devaluation, the Euro itself is ultimately responsible.

Here’s some more light reading.

http://www.zerohedge.com/news/2015-06-29/good-you-alexis-tsipras-part-1

http://www.zerohedge.com/news/2015-06-29/french-economy-dire-straits-worse-anyone-can-imagine-leaked-nsa-cable-reveals

http://www.zerohedge.com/news/2015-06-25/forget-grexit-madame-frexit-says-france-next-french-presidential-frontrunner-wants-o

http://www.zerohedge.com/news/2015-06-12/deutsche-bank-next-lehman

Comment » | Deflation, EU, EUR, Greece, Macro, PIIGS, QE, The Euro