Subprime Act 2 Part 2

Following up on my recent repost of John Mauldin’s last letter, I think it’s worth posting the followup.

As I mentioned his letter is free and well worth reading. Sign up here

I’ve snipped the end bit but otherwise repeated it in full.

Eye popping….

<<

At the end of last week’s letter on the whole mortgage foreclosure mess, I wrote:

“All those subprime and Alt-A mortgages written in the middle of the last decade? They were packaged and sold in securities. They have had huge losses. But those securities had representations and warranties about what was in them. And guess what, the investment banks may have stretched credibility about those warranties. There is the real probability that the investment banks that sold them are going to have to buy them back. We are talking the potential for multiple hundreds of billions of dollars in losses that will have to be eaten by the large investment banks. We will get into details, but it could create the potential for some banks to have real problems.”

Real problems indeed. Seems the Fed, PIMCO, and others are suing Countrywide over this very topic. We will go into detail later in this week’s letter, covering the massive fraud involved in the sale of mortgage-backed securities. Frankly, this is scandalous. It is almost too much to contemplate, but I will make an effort.

But first, let me acknowledge the huge deluge of emails I got over last week’s letter, the most I can ever remember. I thought about just making this week’s letter a response to many of them, but decided I needed to go ahead and finish the topic at hand. Maybe another time. As a side note, I quoted a letter that came to me anonymously via David Kotok. I said if I found out who wrote it, I would give them credit. It was originally written by Gonzalo Liro, at www.gonzalolira.blogspot.com.

Many of you wrote to point out that his argument about the tracking of title was not correct, but others pointed out many other issues as well. This is one of the most complex problems we face, and I got a lot of good information from readers. It just makes me wish I had our new web site finished so you could avail yourselves of the wisdom among my readers. We are close, down to final changes. And now, on to today’s letter.

They Knew What They Were Selling

It’s hard to know where to start. There is just so much here. So let’s begin with testimony from Mr. Richard Bowen, former senior vice-president and business chief underwriter with CitiMortgage Inc. This was given to the Financial Crisis Inquiry Commission Hearing on Subprime Lending andnd Securitization andnd Government Sponsored Enterprises. I am going to excerpt from his testimony, but you can read the whole thing (if you have a strong stomach) at http://fcic.gov/hearings/pdfs/2010-0407-Bowen.pdf. (Emphasis obviously mine.)

“The delegated flow channel purchased approximately $50 billion of prime mortgages annually. These mortgages were not underwriten by us before they were purchased. My Quality Assurance area was responsible for underwriting a small sample of the files post-purchase to ensure credit quality was maintained.

“These mortgages were sold to Fannie Mae, Freddie Mac [We will come back to this – JM] and other investors. Although we did not underwrite these mortgages, Citi did rep and warrant to the investors that the mortgages were underwritten to Citi credit guidelines.

“In mid-2006 I discovered that over 60% of these mortgages purchased and sold were defective. Because Citi had given reps and warrants to the investors that the mortgages were not defective, the investors could force Citi to repurchase many billions of dollars of these defective assets. This situation represented a large potential risk to the shareholders of Citigroup.

“I started issuing warnings in June of 2006 and attempted to get management to address these critical risk issues. These warnings continued through 2007 and went to all levels of the Consumer Lending Group. “We continued to purchase and sell to investors even larger volumes of mortgages through 2007. And defective mortgages increased during 2007 to over 80% of production.”

Mr. Bowen was no young kid. He had 35 years of experience. He was the guy they hired to pay attention to the risks, and they ignored him. How could a senior manager not get such an email and not notify his boss, if only to protect his own ass? They had to have known what they were selling all the way up and down the ladder. But the music was playing and Chuck Prince said to dance and rake in the profits (and bonuses!). More from his testimony:

“Beginning in 2006 I issued many warnings to management concerning these practices, and specifically objected to the purchase of many identified pools. I believed that these practices exposed Citi to substantial risk of loss.

Warning to Mr. Robert Rubin and Management

“On November 3, 2007, I sent an email to Mr. Robert Rubin and three other members of Corporate Management… In this email I outlined the business practices that I had witnessed and attempted to address. I specifically warned about the extreme risks that existed within the Consumer Lending Group. And I warned that there were ‘resulting significant but possibly unrecognized financial losses existing within Citigroup.'”

And now taxpayers own 75% of Citi, and our losses to them are huge. They are going to get worse, as we will see.

Now let’s turn to the testimony of Keith Johnson, who worked for various mortgage companies and in 2006 became the president and chief operating officer of Clayton Holdings, the largest residential loan due diligence and securitization surveillance company in the United States and Europe. This is testimony he gave before the Financial Crisis Inquiry Commission. Part of the testimony is by his associate Vicki Beal, senior vice-president of Clayton. The transcript is some 277 pages long, so let me summarize.

Investment banks would come to Clayton and give then roughly 10% of the mortgages that they intended to buy and put into a security. Clayton rated them on whether the documentation was what it was supposed to be, not as to whether they thought it was a good loan. Still, 46% of the loans did not have proper documentation (out of a pool of 9 million loans) and 28% had what was determined to be level 3 disqualifications that simply had no mitigating circumstances. Understand, these were loans that were already written, and there was no effort to check the facts, just the documentation.

And ultimately 11% of these loans (39% of the level 3’s) were put back in by the investment bank. And what happened to the loans that were rejected? (This might require an adult beverage and a few expletives deleted.)

Popping Through

They were put back into another pool, where again only 10% of the loans were examined. Quoting from the testimony:

“MR. JOHNSON: I think it goes to the ‘three strikes, you’re out’ rule.

“CHAIRMAN ANGELIDES: So this was a case of – okay, three strikes.

“MR. JOHNSON: I’ve heard that even used. Try it once, try it twice, try it three times, and if you can’t get it out, then put –

“CHAIRMAN ANGELIDES: Well, the odds are pretty good if you are sampling 5 to 10 percent that you’ll pop through. When you said the good, the bad, the ugly, the ugly will pop through.”

Yes, you read that right. If a loan was rejected a second time, it went back into yet another pool for a third try. The odds of coming up three times, when only 5 or 10 percent are sampled? About 1 in a thousand. Popping through, indeed.

Clayton presented their data to the ratings agencies, investment banks, and others in the industry. They were frustrated that no one was really paying attention or taking heed of their warnings.

Here is what Shahien Nasiripour, the business reporter for the Huffington Post, wrote (his emphasis). For those interested, the entire article is worth reading. ( http://www.huffingtonpost.com/2010/09/25/wall-street-subprime-crisis_n_739294.html):

“Johnson told the crisis panel that he thought the firm’s findings should have been disclosed to investors during this period. He added that he saw one European deal mention it, but nothing else.

“The firm’s findings could have been ‘material,’ Johnson said, using a legal adjective that could determine cause or affect a judgment.

“It’s unclear whether the firms ended up buying all of those loans, or whether Wall Street securitized them all and sold them off to investors.

“‘Clayton generally does not know which or how many loans the client ultimately purchases,’ Beal said. That likely will be the subject of litigation and investigations going forward.

“‘This should have a phenomenal effect legally, both in terms of the ability of investors to force put-backs and to sue for fraud,’ said Joshua Rosner, managing director at independent research consultancy Graham Fisher & Co.

“‘Original buyers of these securities could sue for fraud; distressed investors, who buy assets on the cheap, could force issuers to take back the mortgages and swallow the losses.

“‘I don’t think people are really thinking about this,’ Rosner said. ‘This is not just errors and omissions – this appears to be fraud, especially if there is evidence to demonstrate that they went back and used the due diligence reports to justify paying lower prices for the loans, and did not inform the investors of that.”

“Beal testified that Clayton’s clients use the firm’s reports to ‘negotiate better prices on pools of loans they are considering for purchase,’ among other uses.

“Nearly $1.7 trillion in securities backed by mortgages not guaranteed by the government were sold to investors during those 18 months, according to Inside Mortgage Finance. Wall Street banks sold much of that. At its peak, the amount of outstanding so-called non-agency mortgage securities reached $2.3 trillion in June 2007, according to data compiled by Bloomberg. Less than $1.4 trillion remain as investors refused to buy new issuance and the mortgages underpinning existing securities were either paid off or written off as losses, Bloomberg data show.

“The potential for liability on the part of the issuer ‘probably does give an investor more grounds for a lawsuit than they would ordinarily have’, Cecala said. ‘Generally, to go after an issuer you really have to prove that they knowingly did something wrong. This certainly seems to lend credibility to that argument.’

“‘This appears to be a massive fraud perpetrated on the investing public on a scale never before seen,’ Rosner added.”

It’s Time for Some Putback Payback

Investment banks large and small originated a lot of subprime garbage in the 2005-2007 era. This week PIMCO, Black Rock, Freddie Mac, the New York Fed, and – what I think is key and no one has picked up on – Neuberger Berman Europe, Ltd., an investment manager to a managed-account client, came together and sued Countrywide for not putting back bad mortgages to its parent, Bank of America. This is the first of what will be a series of suits aimed at getting control of the portfolio and peeking into the mortgages. (Text of lawsuit at http://www.ritholtz.com/blog/2010/10/full-text-of-letter-to-bofa-from-ny-fed-maiden-lane-freddie-mac-pimco-western-asset-mgmt-neuberger-berman-kore-advisors/)

Basically, if buyers of 25% or more of a mortgage-backed security can come together, they have standing to sue the mortgage servicer to do its duty to the investors and make putbacks of bad mortgages, and if they fail to do so the plaintiffs can take control of the process and take the issuer to court directly (that’s a very simplistic description but roughly accurate).

There are two key take-aways. First, note that a European entity is involved. Hundreds of billions of dollars of this junk was sold to European banks and funds. And these guys get together at conferences (sometimes they even invite me to speak). So Helmut will be talking to Lars who will talk to Jean Pierre and they will realize they all own some of this junk. They will be watching with very real interest to see how the big boys at PIMCO and Black Rock and the New York Fed fare in their efforts. And then you can count on them all piling on (more later on this).

Second, little noticed this week was the fact that The Litigation Daily wrote that Philippe Selendy of Quinn Emanuel Urquhart & Sullivan has been retained by the Federal Housing Finance Agency (FHFA), which oversees Fannie Mae and Freddie Mac, to investigate billions of dollars in potential claims against banks and other issuers of mortgage-backed securities.

Who? Not on your celebrity list? Just wait. He will soon be getting the best tables everywhere. He and his firm are the guys representing MBIA in all their cases against Countrywide and Merrill Lynch. And they are kicking ass. Slowly to be sure, but very steady. That means Fannie and Freddie are getting ready to get serious.

They were sold well over $227 billion of the subprime garbage issued in 2006 and 2007. And the bad stuff started before then. But they have one advantage that the guys at PIMCO, et al. don’t have: they (or actually the FHFA) are a federal agency. That means they have subpoena power. The agency has sent 64 subpoenas to issuers of mortgage-backed securities, and although they have not said who they went to, they obviously include almost everyone and clearly all the big players. (They couldn’t have ignored Goldman, could they? Naah. Too obvious.)

From American Lawyer.com (I know, this website is probably already on your favorites list, but for those souls who actually have a life I provide the text):

“Through those subpoenas, the agency could gain access to the loan files for the mortgages that backed the securities it bought and thus establish whether the mortgages were what the issuers represented them to be in securities contracts. According to the Journal, the difficulty of obtaining loan files has been a big obstacle for investors trying to force issuers to repurchase bonds.

“If the FHFA were to decide down the road to initiate litigation, it would still have to have the support of a percentage (usually 25 percent) of its fellow bondholders for each issue. But given what the agency and its Quinn lawyers will be able to see before bringing suit, it probably won’t be too hard to get other investors on the bandwagon.” ( http://www.quinnemanuel.com/media/183456/hurricane%20warnings%20fannie%20mae%20and%20freddie%20mac%20hire….pdf) It is tough not to jump to the conclusion, but we need one more piece of the puzzle before we get there.

The Worst Deal of the Decade?

Arguably Bank of America had Merrill shoved down their throats, but no one can say that about the acquisition of Countrywide. And Countrywide could end up costing BAC $50 billion or more in losses. That may prove to be a serious candidate for worst deal of the decade. (Although WAMU is a leading candidate too!)

Let’s look at a report by Branch Hill Capital, a hedge fund out of San Francisco. And before we start on it, let me point out they are short Bank of America. You can see the full PowerPoint at http://www.businessinsider.com/bank-of-america-mortgage-report-2010-10#-1.

(And let me say a big thanks to the author of the report, Manal Mehta, for all the background material he sent me and his help with this week’s letter. It helped make it a lot better. Of course, any erroneous conclusions or outrageous statements are all mine.)

First, they point out that the potential size of Bank of America’s (BAC) liabilities is $74 billion (with a B). And that is just for Countrywide. That does not include Merrill, which is also large. Against that they have set aside $3.9 billion. You can count on more suits than just the PIMCO, et al. mentioned above.

In the MBIA case, the judge has ruled that the suit can proceed even though BAC has denied responsibility. Although on appeal, this is high-stakes poker. Countrywide originated over $1.4 trillion of mortgages in 2005-2007. MBIA alleges that over 90% of the defaulted or delinquent loans in the Countrywide securitizations show material discrepancies. Care to take the under in the over/under bet on that?

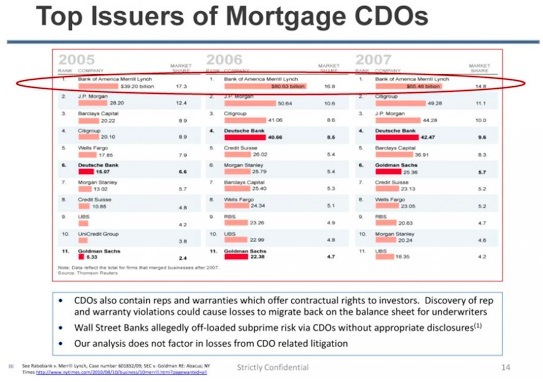

Further to the case on BAC, Merrill was the largest originator of subprime CDOs during the housing boom, for another $120 billion, along with about $255 billion of residential mortgage-backed securities.

And then there are all those CDOs (collaterized debt obligations). Merrill did a lot of those that went sour. This deserves it own leter, but a gentleman named Wing Chau went from making $140k a year to $25 million in just a few years, putting together CDOs from Merrill, some of which were completely bankrupt in just six months.

Countrywide has already settled with the New York pension funds for $624 million, one of the largest securities fraud settlements in US history. And the line is growing longer.

Of course, BAC CEO Brian Moynihan denied this week that there is a problem. Let’s look at Moynihan’s statements at the last earnings call and compare them to what the judge in the case said earlier. Moynihan:

“… we execute repurchases on a loan by loan basis… And as we learn more, and again, our perspective on this – we’re going to be quite diligent as I said in defending the interest of our shareholders. This really gets down to a loan-by-loan determination and we have, we believe, the resources to deploy against that kind of a review.”

Back in June the judge on the case (a Judge Bransten) said (from the transcript):

“I think that it makes all the sense in the world that you can use a sample to prove the case because otherwise I can’t imagine a jury listening to 386 thousand cases. Even if you have that available, nevertheless you are not going to present that to a jury or even to a judge. I’m patient but not that patient. So therefore it is going to be a sample in the end…”

OK, let me get this straight, Brian. Your company committed fraud, with robosignings and all the rest, and you won’t man up and take responsibility? You and your lawyers want to thrash this out, case by case, fighting a trench-warfare, rear-guard action? Well I’m afraid that’s not going to work out for you. There are so many examples of Countrywide outright fraud that it is going to be hard to convince a jury that BAC is not on the hook. Will it take years? Of course.

You can read the PowerPoint for details. Bottom line: BAC is probably liable for putbacks that could total over a hundred billion. And that is just BAC.

Think Citi. And any of the scores of mortgage originators and investment banks. There were a couple of trillion dollars in these securitizations issued. Plus how many hundred of billions of second-lien loans? And can we forget CDOs? And CDOs squared?

And let’s not forget all those completely synthetic CDOs that were written at the height of the mania. Most of it AAA, of course. Frankly, anyone stupid enough to buy a synthetic CDO should lose their money, but that is not what the courts will base their decision on. It is all about representations and warranties. And maybe a little fraud.

I picked on BAC because that is the analysis I saw. But it could be any of dozens of banks. Look at this list from the Branch Hill PowerPoint.

Could we see a hundred billion in losses to the major banks? In my opinion we will for sure, over time. $200 billion? Probably. $300 billion? Maybe. $400 billion? It depends on how organized the investors in the securities get and what gets settled out of court. Out of a few trillion dollars in securitizations? It’s anybody’s guess. I just made mine.

But let’s not forget the $227 billion sold to Fannie and Freddie. Taxpayers are on the hook for $300-400 billion in losses. Those putbacks could save us a lot. Will this threaten the viability of some banks? Maybe. But most will survive. BAC made $3 billion last quarter. A steep yield curve (with the help of the Fed) can cure a lot of evils. But it will absorb the profits of a lot of banks for a long time.

And that of course, will come back to haunt the rest of us as banks have to raise more capital and get more conservative.

Anyone who owns stocks in banks with relatively large MBS exposure is not investing, they are gambling that the losses will not be more than management is telling them. There will be no bailouts (at least I hope not) this time around. Fool me once, shame on you; fool me twice, shame on me. There will be little sympathy for shareholders or bondholders this time, if it comes to that.

One more sad point. The FDIC (read taxpayers) is liable for some of this, as they took over some of these institutions. It just keeps on coming.

Final rant. If you were part of a group that knowingly created or sold flawed and fraudulent mortgage-backed securities to pensions and insurance companies and took home tens of millions in bonuses, up and down the management chain, maybe you should consider moving yourself and your money to a country that does not honor US extradition, because my guess is that, as all this comes out, you may have to hire some very expensive lawyers and get measured for pinstripes.

And the Mozilo agreement was a sham. Sigh. That would be the equivalent of fining me $10,000 and letting me keep my tanning bed. I don’t have the space to go into the fraud at Countrywide, but their internal documents show they all knew what was going on.

>>