Another great article on Gold

Submitted by Alasdair Macleod, via GoldMoney.com,

Introduction

In this article I will argue that the recent slide in the gold price has generated substantial demand for bullion that will likely bring forward a financial and systemic disaster for both central and bullion banks that has been brewing for a long time. To understand why, we must examine their role and motivations in precious metals markets and assess current ownership of physical gold, while putting investor emotion into its proper context.In the West (by which in this article I broadly mean North America and Europe) the financial community treats gold as an investment. However, of the global pool of gold, which GoldMoney estimates to be about 160,000 tonnes, the amount actually held by western investors in portfolios is a very small fraction of this amount. Furthermore investor behaviour, which in itself accounts for just part of the West’s bullion demand, is sharply at odds with the hoarders’ objectives, which is behind underlying tensions in bullion markets. To compound the problem, analysts, whose focus incorporates portfolio investment theories and assumptions, have very little understanding of the economic case for precious metals, being schooled in modern neo-classical economic theories.

These economic theories, coupled with modern investment analysis when applied to bullion pricing, have failed to understand the growing human desire for protection from monetary instability. The result has for a considerable time been the suppression of bullion prices in capital markets below their natural level of balance set by supply and demand. Furthermore, the value put on precious metals by hoarders in the West has been less than the value to hoarders in other countries, particularly the growing numbers of savers in Asia.

These tensions, if they persist, are bound to contribute to the eventual destruction of paper currencies.

The ownership of gold

The amount of gold bullion that backs investor-driven markets is not statistically recorded, but we can illustrate its significance relative to total stocks by referring back to the time of the oil crisis of the mid-1970s. In 1974 the global stock of gold was estimated to be half that of today, at about 80,000 tonnes. Monetary gold was about 37,000 tonnes, leaving 43,000 tonnes in the form of non-monetary bullion, coins and jewellery. Let us arbitrarily assume, on the basis of global wealth distribution, that two thirds of this was held by the minority population in the West, amounting to about 30,000 tonnes.

This figure probably grew somewhat before the early 1980s, spurred by the bull market and growing fear of inflation, which saw investors buy mainly coins and mining shares. Demand for gold bars was driven by the rapid accumulation of dollars in the oil-exporting nations, as well as some hoarding by wealthy investors from all over the world through Switzerland and London.

The sharp rise in global interest rates in the Volcker era, the subsequent decline of the inflation threat and the resulting bear market for gold inevitably led to a reduction of bullion holdings by wealthy investors in the West. Swiss and other private banks, employing a new generation of fund managers and investment advisors trained in modern portfolio theories, started selling their customers’ bullion positions in the 1980s, leaving very little by 2000. In the latter stages of the bear market, jewellery sales in the West became a replacement source of bullion supply, but this was insufficient to compensate for massive portfolio liquidation.

So by the year 2000, Western ownership of non-monetary gold suffered the severe attrition of a twenty-year bear market and the reduction of inflation expectations. Portfolios, which routinely had 10-15% exposure to gold 40 years ago even today have virtually no exposure at all. Given that jewellery consumption in Europe and North America was only 400-750 tonnes per annum over the period, by the year 2000 overall gold ownership in the West must have declined significantly from the 1974 guesstimate of 30,000 tonnes. While the total gold stock in 2000 stood at 128,000 tonnes, the virtual elimination of portfolio holdings will have left Western holders with little more than perhaps an accumulation of jewellery, coins and not much else: bar ownership would have been at a very low ebb.

Since 2000, demand from countries such as India and more recently China is known to have increased sharply, supporting the thesis that gold has continued to accumulate at an accelerating pace in non-Western hands.

Western bullion markets have therefore been on the edge of a physical stock crisis for some time. Much of the West’s physical gold ownership since 2000 has been satisfied by recycling scrap originating in the West, suggesting that total gold ownership in the West today barely rose before the banking crisis despite a tripling of prices. Meanwhile the disparity between demand for gold in the West compared with the rest of the world has continued, while the West’s investment management community has been actively discouraging investment.

The result has been that nearly all new mine production and Western central bank supply has been absorbed by non-Western hoarders and their central banks. While post-banking crisis there has presumably been a pick-up in Western hoarding, as evidenced by ETF and coin sales and some institutional involvement, it is dwarfed by demand from other countries. So it is reasonable to conclude that of the total stock of non-monetary gold, very little of it is left in Western hands. And so long as the pressure for migration out of the West’s ownership continues, there will come a point where there is so little gold left that futures and forwards markets cease to operate effectively. That point might have actually arrived, signalled by attempts to smash the price this month.

This admittedly broad-brush assessment has important implications for the price stability essential to bullion banks operating in paper markets as well as for central banks attempting to maintain confidence in their paper currencies.

Precious metals in capital marketsIn the West itself, the attitudes of the investment community are fundamentally different from even those of the majority of Western hoarders, who are looking for protection from systemic and currency risks as opposed to investment returns. Western investors are generally oblivious to the implications, the most fundamental of which is that falling prices actually stimulate physical demand. Before the recent dramatic slide in prices the investment community undervalued precious metals compared with Western hoarders, let alone those in Asia, encouraging physical bullion to migrate from financial markets both to firmer hands in the West as well as the bulk of it to non-West ownership. There is now irrefutable evidence that these flows have accelerated significantly on lower prices in recent weeks, as rational price theory would lead one to expect.

Pricing bullion is therefore not as simple as the investment community generally believes. It is being put about, mostly on grounds of technical analysis, that the bull markets in gold and silver have ended, and precious metals have entered a new downtrend. The evidence cited is that medium and longer-term moving averages have been violated and are now falling; furthermore important support levels have been breached.

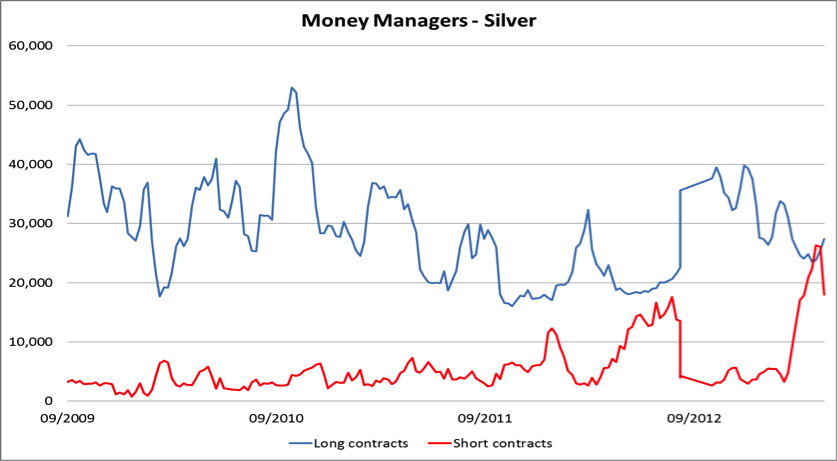

These developments, which arise out of the futures and forward markets, have rattled Western investors who thought they were in for an easy ride. However, a close examination of futures trading shows the bearish case even on investment grounds is flawed, as the following two charts of official statistics provided by weekly Commitment of Traders data clearly show.

The Money Managers category is the clearest reflection in the official data of investor portfolio positions, representing sizeable mutual and hedge funds. In both cases, the number of long contracts is at historically low levels, and shorts, arguably the better reflection of money-manager sentiment, remain close to high extremes. On this basis, investor sentiment is clearly very bearish already, with the investment management community already committed to falling prices. Put very simplistically there are now more buyers than sellers.

Money Managers are in stark opposition to the Commercials, who seek to transfer entrepreneurial risk to Money Managers and other investor and speculator categories. The official statistics break Commercials down into two categories: Producer/Merchant/Processor/User, and Swap Dealers. Both categories include the activities of bullion banks, which in practice supply liquidity to the market. Because investors and speculators tend to run bull positions, bullion banks acting as market-makers will in aggregate always be short. A successful bullion bank trader will seek to make trading profits large enough to compensate for any losses on his net short position that arise from rising prices.

A bullion bank trader must avoid carrying large short positions if in his judgement prices are likely to rise. He will be more relaxed about maintaining a bear position in falling markets. Crucially, he must keep these opinions private, and the release of market statistics are designed to accommodate these dealers’ need for secrecy.

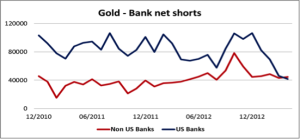

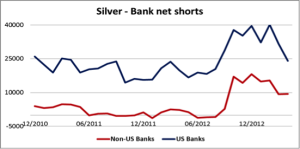

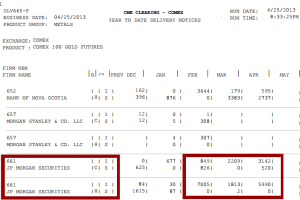

Bullion banks’ position details are disclosed at the beginning of every month in the Bank Participation Reports, again official statistics. They are broken down into two categories, based on the individual bank’s self-description on the CFTC’s Form 40, into US and Non-US Banks. Their positions are shown in the next two charts (note the time scale is monthly).

In both gold and silver, the bullion banks have managed to reduce their exposure from extreme net short over the last four months. The reduction of their market exposure suggests that they have been deliberately transferring this risk to other parties, and is consistent with an anticipation that bullion prices will rise. It is the other side of the high level of bearishness reflected in the Money Manager category shown in the first two charts. The bullion banks control the market; the Money Managers are merely tools of their trade.

There has been little reduction in open interest in gold and it has remained strong in silver, because risk has been transferred rather than extinguished. Daily official statistics on open interest are provided by the exchange and summarised in the next two charts (note that data is daily).

From these charts it can be seen that recent declines in the gold price are failing to reduce open interest further, and in silver open interest remains stubbornly high. Therefore, attempts by bullion banks to reduce their net short exposure by marking prices down are showing signs of failure.

We can therefore conclude that investor sentiment is at bearish extremes and the bullion banks have reduced their net short exposure to levels where it risks rising again. Therefore the downside for precious metals prices appears to be severely limited, contrary to sentiments expressed by technical analysts and in the media.

This market position is against a background of a growing shortage of physical bullion, which is our next topic.

Physical markets

Casual observers of precious metal prices are generally unaware that the headline writers focus on activity in the futures markets and generally ignore developments in physical bullion. This is consistent with the fact that market data is available in the former, while dealing in the latter is secretive. However, as with icebergs, it is not what you see above the water that matters so much as that which is out of sight below.

It is not often understood in investment circles that gold and silver are commodities for which the laws of supply and demand are not overridden by investor psychology. Therefore, if the price falls, demand increases. Indeed, the increase in demand has far outweighed selling by nervous investors; even before the price-drop, demand for both silver and gold significantly exceeded supply. Evidence ranges from readily available statistics on record demand for newly-minted gold and silver coins and the net accumulation of gold by non-Western central banks, to trade-based information such as imports and exports of non-monetary gold as well as reports from trade associations reporting demand in diverse countries such as India, China, the UK, US, Japan and even Australia.

All this evidence points in the same direction: that physical demand is increasing on every price drop. There is therefore a growing pricing conflict between futures and forward markets, which do not generally involve settlement but the rolling-over of speculative positions, and of the underlying physical metal. Furthermore, analysts make the mistake of looking at gold purely in terms of mining and scrap supply, when nearly all gold ever mined is theoretically available to the market, in the right conditions and at the right price. The other side of this larger coin is that if the price of gold is suppressed by activity in paper markets to below what it would otherwise be, the stimulus for physical demand, being based on a 160,000 tonne market, is likely to be considerably greater on a given price drop than analysts who are myopic beyond 2,750 tonnes of annual mine production might expect. The numbers that are available confirm this to have been the case, particularly over the last few weeks, with reports from all over the world of an unprecedented surge in demand.

This is at the root of a developing crisis of which few commentators are as yet aware. Demand for physical has accelerated the transfer of bullion from capital markets to hoarders everywhere and from the West’s capital markets to other countries, which has been the trend since the oil crisis in the mid-Seventies. This is what’s behind an acute shortage of physical gold in capital markets, explaining perhaps why bullion banks feel the need to reduce their short positions.

While we can detail their exposure in futures markets, meaningful statistics are not available in over-the-counter forward markets, particularly for London, which dominates this form of trading. Forwards are considerably more flexible than futures as a trading medium, generating trading profits, commissions, fees and collateralised banking business. The ability to run unallocated client accounts, whereby a client’s gold is taken onto a bank’s balance sheet, is in stable market conditions an extremely profitable activity, made more profitable by high operational gearing. The result is that paper forward positions are many multiples of the physical bullion available. The extent of this relationship between physical bullion and paper is not recorded, but judging by the daily turnover in London there is an enormous synthetic short physical position. For this reason a sharply rising price would be catastrophic and any drain on bullion supplies rapidly escalates the risk.

Overseeing this market is the Bank of England co-operating with other Western central banks and the Bank for International Settlements, whose combined interest obviously favours price stability. They have been quick to supply the market if needed, confirmed by freely-admitted leasing operations in the past, and by secretive supply into the market, which has been detected by independent supply and demand analysis over the last 15 years. Furthermore, as currency-issuing banks, central banks are unlikely to take kindly to market signals that suggest gold is a better store of value than their own paper money.

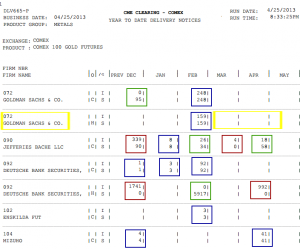

We can only speculate about day-to-day interventions by Western central banks in gold markets. In this regard it seems that the slide in prices on the 12th and 15th April was triggered by a very large seller of paper gold; if this market story and the amount mentioned are correct, it can only be central bank intervention, acting to deliberately drive prices lower. Given the market position, with Money Managers in the futures markets already short and highly vulnerable to a bear squeeze, the story seems credible. The objective would be to persuade holders of physical ETFs and allocated gold accounts to sell and supply the market, on the assumption that they would behave as investors convinced the bull market is over.

Conclusions

For the last 40 years gold bullion ownership has been migrating from West to elsewhere, mostly the Middle East and Asia, where it is more valued. The buyers are not investors, but hoarders less complacent about the future for paper currencies than the West’s banking and investment community. There was a shortage of physical metal in the major centres before the recent price fall, which has only become more acute, fully absorbing ETF and other liquidation, which is small in comparison to the demand created by lower prices. If the fall was engineered with the collusion of central banks it has backfired spectacularly.

The time when central banks will be unable to continue to manage bullion markets by intervention has probably been brought closer. They will face having to rescue the bullion banks from the crisis of rising gold and silver prices by other means, if only to maintain confidence in paper currencies. Any gold held by struggling eurozone nations, theoretically available to supply markets as a stop-gap, will not last long and may have been already sold.

This will likely develop into another financial crisis at the worst possible moment, when central banks are already being forced to flood markets with paper currency to keep interest rates down, banks solvent, and to finance governments’ day-to-day spending. Its importance is that it threatens more than any other of the various crises to destabilise confidence in government-backed currencies, bringing an early end to all attempts to manage the others systemic problems.

History might judge April 2013 as the month when through precipitate action in bullion markets Western central banks and the banking community finally began to lose control over all financial markets.

Basically what he’s saying is that, just as the credit markets consist of so much fractional fiat on top of very little of value, so the unallocated forward market for physical gold now consists of many multiples of actual physical reserves having been sold forward.

The credit markets will cease to function as assets supporting extended credit get wiped out leading to waves of bank insolvency rippling through the banking system. When this happens, J.P. Morgan’s comment that “Money is gold and nothing more” will become bleedin’ obvious and the bullion banks will then be hit by unmeetable demands for delivery of the forward sold bullion.

Should be fun. Or not.