September 25th, 2016 — 4:34am

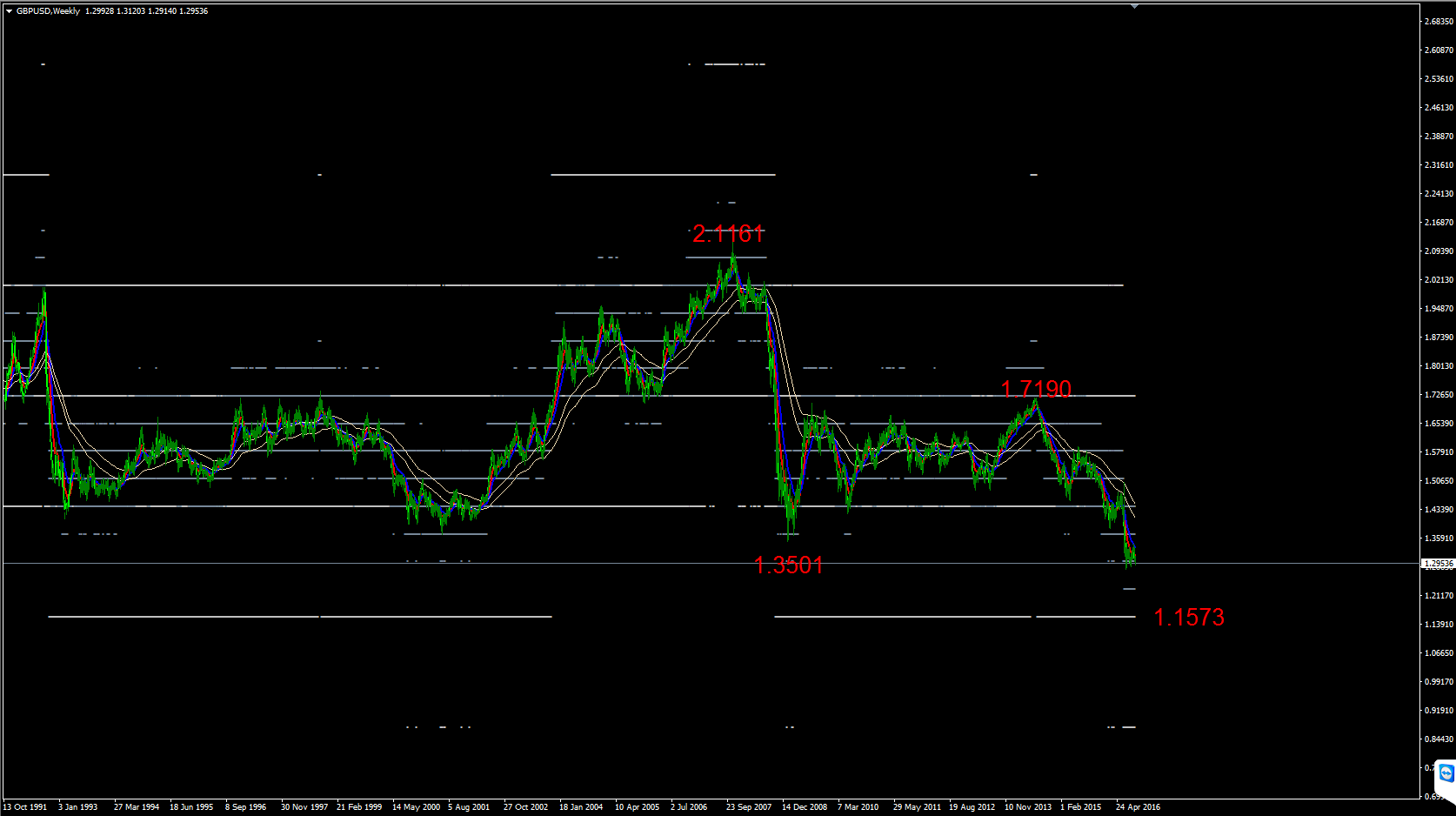

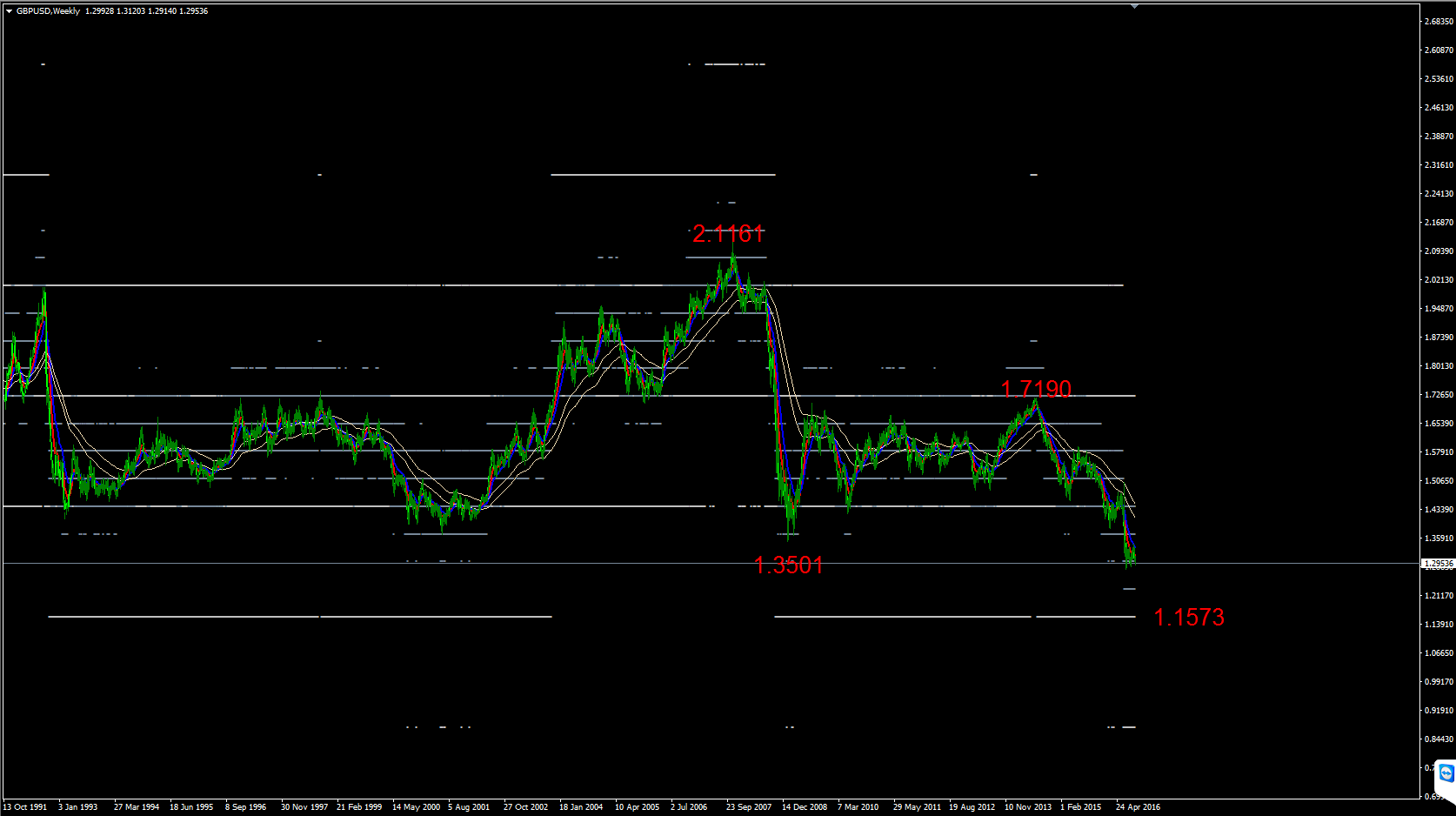

Post Brexit weakness looks set to continue, as the market ended the week near the lows.

The previous major decline from 2.1161 to 1.35 took the market 76.6 big figures lower. Running some projections of this swing from the 2014 1.7190 high gives targets at 1.2456 which would be 61.8% of that decline or the 1.15/1.14 area which marks 75% of that decline.

Comment » | GBPUSD, Sterling, Technicals

September 9th, 2011 — 8:11am

Watch 1.3837.

If Chinabot doesn’t show up right beneath there then look for 1.3693

Comment » | Deflation, EUR, EURUSD, PIIGS, Technicals, The Euro, USD

August 3rd, 2011 — 3:18pm

Predictions are hard to make, especially about the future, but following the latest piece from AEP in the telegraph, where he states :

“The Chinese central bank’s reserve manager SAFE is clearly buying euros on a large scale to hold down the yuan and safeguard export advantage in Europe, but it appears to be purchasing short-term debt of a one-year maturity or less and other liquid assets.”

also..

“The three-month euribor/OIS spread, the fear gauge of credit markets, reached the highest level in two years today, jumping 7 basis points to 40 in wild trading.

“Europe’s money markets are undoubtedly starting to freeze up,” said Marc Ostwald from Monument Securities.

“It’s not as dramatic as pre-Lehman but it is alarming and shows the pervasive degree of fear in the markets. People are again refusing to lend except on a secured basis.”

If those with demand for Euros can’t borrow any, short term rates will go up, even if the market is non functioning. This will put upward pressure on the currency…. Given that we’re sitting in the middle of the range formed since the low in May, and given the violence of the rejection of each new low seen during the last couple of days’ trading, a break to the upside of this range is now not inconceivable. The “negative” outlook for the eurozone probably means that the market is short, which to me warns of the possibility of a significant move higher.

1.51 is back in the frame.

Negated by a break back below 1.40.

Comment » | EUR, EURUSD, Geo Politics, Macro, Technicals, The Euro

November 19th, 2010 — 8:30pm

The market has failed after a temporary penetration of the 1.3693 level, and a rejection of the ‘mean channel’. It is still possible that a low has formed, but if the market is forming a base, then we would expect a higher bottom above the week’s 1.3446 low. Potential supports for such a higher bottom would be at 1.3516.

Comment » | EURUSD, Technicals

November 18th, 2010 — 10:55pm

Further gains to 1.6079 but the action below the 1.6296 high appears corrective and may not yet be complete.

We would look either for a higher bottom above 1.5893 or a resumption of impulsive upside.

Comment » | GBPUSD, Technicals

November 18th, 2010 — 10:43pm

So much for our expectation of resistance at .9805, as the rejection of the lows has carried the market back to .9894 and the long term ‘mean channel’ on the four hour chart.

So far the .9724 low which formed on the 16th, leaves a higher bottom in place and the market appears to be in some consolidation pattern below the 1.0182 high. The longer term outlook remains positive for the aussie, but the pattern of activity below that high appears to signal that the market has entered a longer term period of corrective activity which should see lots of overlap of previous swings and could see the market ranging between 1.00 and the .95 area.

Above, we expect resistance at .9982 and 1.0070; while below we expect to find support at .9805, .9717, .9629, and .9540.

Comment » | AUDUSD, Technicals

November 17th, 2010 — 9:04am

The decline witnessed in this pair is less pronounced than in others, but further downside appears likely, setting up a possible test of old low supports between .9629 and .9540.

Expect rallies to be capped by .9805.

Comment » | AUDUSD, Technicals

November 17th, 2010 — 8:50am

The impulsiveness of the decline has carried the market below our 1.3516 objective and, as the daily chart shows, this move has penetrated the channel support drawn up off the September low. This is now a fairly critical juncture for the market; declines remain impulsive in nature and rallies continue to resemble corrective action, suggesting a move to the slower channel support which coincides with the band of consolidation commencing with the 1.3163 level. 1.3516 is now capping the market and a recovery of the 1.3693 area would really be required to signal an end to this decline.

Comment » | EURUSD, Technicals

November 9th, 2010 — 10:55pm

The impulsiveness of the decline appears to signal that the market is now in retreat in search of support back towards the channel drawn up off the early September low. A break of 1.3693 would suggest 1.3516.

Comment » | EURUSD, Technicals

November 9th, 2010 — 10:49pm

OK so weakness has materialised, with a relatively sharp move back to the lower end of our band of targets near .9982. We are now sitting on what should be support, suggesting potential for less impulsive weakness. In the event that there is no rejection of this support, we would then anticipate a probe of the band of consolidation extending back to .9805.

Comment » | AUDUSD, Technicals