The “Game Over” Redux

Submitted by Tyler Durden on 05/19/2011 21:01 -0400

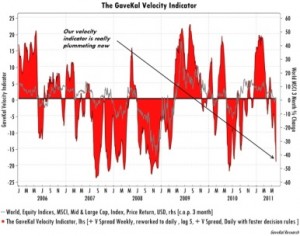

Back in November, we posted a piece by Knight Research titled “The Game Is Over” in which the firm’s strategist Mark Lapolla presented his thesis why he believes that “the structural and cyclical terms of global trade have finally reached their tipping point. This will catalyze a wholesale change in sentiment and a historic repositioning of risk assets. The emerging market global growth story is over.” And while the article came out just as the barrage of $750 billion in daily POMOs courtesy of QE2 was starting and hence masked the true state of reality, now that QE2 is finishing, it is only appropriate to bring Mark back up front, as the imminent and very violent convergence of the rosy myth that is the stock market, and of the underlying miserable reality, is about to wake up all those who have been dozing under the Printer Piper of Eccleslin’s soothing tune, and Lapolla’s thesis is about to see its first validation. In essence, while we have heard much from those who claim that the end game will come as a result of hyperinflation, Lapolla is convinced in the opposite: namely that the end will be not a bang but a hyperdeflationary whimper. In order to refresh readers with his thoughts, recently Lapolla conducted an interview with the master questioner Kate Welling in which the Knight strategist laid out his uber-bearish case in more gruesome detail than most can stomach. Below we present the key points from his interview, as well as the full thing subsequently.

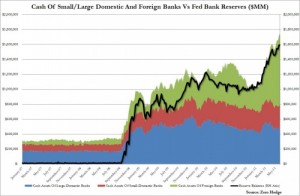

In a nutshell, and this won’t come as a surprise to anyone, Lapolla believes that “the game is over because there is no collateral… When consumer debt is rooted 75%-plus in residential real estate and residential real estate is impaired, easy Federal Reserve monetary policy simply cannot make it to Main Street. The transmission mechanism is broken. There is no conduit. ”

Lapolla’s observations on the secular shift in the employment structure:

What’s going on here is very simple. John Maynard Keynes wrote a letter entitled, “Economic Possibilities for our Grandchildren “in 1930, in which he coined the term “technological unemployment.” He said it’s a term nobody has heard of, but you are going to be hearing a lot about it. Of course, he was writing about the use of technology to supplant labor in the factory… Any way you slice it, nominal wages, real wages, hourly wages, the duration of unemployment — all of these measures imply that we have a growing structural fracture in the labor markets.

On the irrelevance of week to week and month to month micro fluctuations in the jobs numbers:

Right now, the full employment gap is running about 11 million jobs. That’s a shocking gap and, although this is very difficult to quantify, we have a sinking suspicion that — while a number of the jobs that are being created right now might in fact be “good jobs” – they’re being filled by over-qualified labor no longer able to wait for jobs at compensation levels similar to what they had before. Now, in the very long run, this might work itself out, but in the short run it doesn’t do anything to change the outlook for the consumer. What it does is suggest that people are going to have to shift down the way they live and the way they expect to live — perhaps even further than they already have. Thus, the propensity to save in this country has to continue to rise — which (although not in the short term) is very bullish long term — whether that’s captured in the aggregate data or not. So as you’ve gathered, we are very different from consensus, first and foremost, when it comes to the secular structure of labor and credit in the U.S.

On the previously discussed topic of Squatter’s Rent (discussed extensively here):

There are roughly six to seven million folks who are no longer paying on the mortgages on their homes, so if we do some really simple arithmetic, it suggests in the aggregate as much as $100 billion of annualized consumer income is being freed up to find its way into consumer spending elsewhere in the economy, instead of going towards the satisfaction of housing debt…, the real question is if, or when, does the foreclosure mechanism begin to kick back into gear and then accelerate? At this juncture, there really isn’t a tremendous amount of evidence that it’s going to accelerate. Let me give you a tangible example. We know someone who has lost his job and is in a home with a $1.45 million mortgage. The house is on the market at $1.3 million, which we guess is the degree to which the home has been written down on the books of the mortgage holder. The property taxes on the home are about $20,000 a year, so he has been expecting an eviction notice or a foreclosure proceeding for almost 18 months. Yet his property taxes have been mysteriously paid every year. What is going on is clear: If the bank or whomever holds that mortgage note were to foreclose, the house’s liquidation value is prob¬ably about $900,000. So they would have to take a further $400,000 writedown on that mortgage. Which makes paying $20,000 a year in property taxes, look like a relative bargain.

On Europe’s state of suspended animation:

Europe right now is still kicking the deflationary can down the street; trying to postpone and prolong the inevitable. Meanwhile, they’re trying to cover their tracks with verbiage claiming they’re pursing mandated fiscal and monetary austerity policies and monetary policy. But the ECB’s bump up in rates of 25 basis points isn’t material. And all of this is intensifying the deflationary pressures on the periphery countries. So Europe is in a state of suspended animation, where the deflationary pressures are spilling out but even the sort of modest financial restructuring the United States is trying is still being resisted. It’s clearly not a stable situation.

On the “China” question:

I think the China situation, how¬ever, is profoundly obvious and profoundly simple. The idea that the free world is placing its hope in a repressive, communist regime employing command and control economic management while violating trade protections and human rights everywhere is absolutely astounding, amazing. I would suggest that, in itself, should be a sufficient warning flag. But let’s be a lot more specific. I actually see the situation in China as very analogous to the U.S. in 1929 and Japan in the 1980s….I’ll just tick off eight similarities between China circa 2011 and the U.S. before the Depression. 1) Massive disparity of wealth, income, and education. 2) Rapid industrialization and displacement of labor. 3) Opaque and misleading economic and financial data. 4) Massive build-up of leverage across the “rising” class. 5) Bubbles in both residential real estate and fixed asset/infrastructure development. 6) Accelerating and uncontrolled growth in disintermediated credit. 7) Expected transference of economic growth to domestic demand. And, finally, an accelerating price/wage spiral. Nonetheless, to China’s credit, they have a booming economy which has drawn the attention, admiration and certainly the economic aspirations of the world. The irony is, despite its hubris, China appears to have lost control — and has done so by doing everything it could to avoid that. Essentially, in its own zeal to placate its masses with rapid growth, China has created a tide of inflation that threatens it with wide-spread social unrest. But if it crushes speculation and clamps down on credit, it risks a deflationary collapse that would also threaten social harmony. The upshot is that China no longer controls its own destiny. The free markets do. As an aside, I would suggest that in the not-too distant future, when this all unravels, there will be downside as well as upside for the U.S., particularly as it relates to what we were talking about before, the way the U.S. has benefited from the value of intellectual property versus scale.

On China’s Lewis Point (discussed extensively here):

If there was one thing that pushed us over the edge to publish it last November, it was our belief, now confirmed, that China and an increasing number of other emerging markets are caught in a price/wage spirals that they’re not going to be able to control through monetary, fiscal or legislative policy. These are an inevitable result, not only of the credit boom, but of the manufacturing engine they’re living by. This is the great differentiator between the U.S. and China. The reason a systemic inflation cannot happen here for a long time and why it is happening in China is simply this: When labor is in the business of manufacturing goods (as opposed intellectual property or services), labor has a call on rising finished goods prices. When commodities prices begin to increase and manufacturers attempt to raise finished goods prices, wage rates must go up or labor’s value is necessarily diminished. This is the dynamic traditional U.S. manufacturing businesses faced decades ago, and now, in China, it has reached epic proportions. We’ve seen 20% to 30% wage increases by the government on the low end and by contract manufacturers such as Foxconn (FXCNF), which does the Apple (AAPL) iPhone, on the high end. It has raised wage rates, almost 30%. China bulls believe this wage inflation is good for workers and so ultimately is going to help China accelerate consumer demand as an engine of their growth. Nonetheless, it hasn’t and won’t, for a couple of reasons. 1) Savings rates actually are rising in the major city centers. 2) China’s consumer confidence numbers and research on the ground in China both show that labor has never been less secure than they are now, which seems paradoxical. One would think that China’s new¬found international power, along with higher incomes, would make Chinese workers feel all is right with the world. The problem is that the cost of living is growing even faster. Without getting too technical, China has probably crossed over what’s called, in academic theory, the Lewis Point, where the movement of labor from agriculture into manufacturing reaches a peak and begins to taper off as manufacturing labor begins to reconsider whether life in fact wasn’t better back on the farm.

On the link between inflation and money:

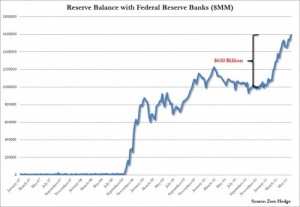

Increased money supply is not a causal factor for inflation. It’s like suggesting that a bartender is a causal factor for alcoholism. In reality, reserves, whether they exist in the system’s books or not, are always available. Credit creation cannot really be controlled. If you and I want to create a loan between ourselves, we can do it. If a bank wants to create a loan, it can do it. The only thing that can mitigate that ability is regulation of the banks. However, if we consider the off-balance-sheet and shadow banking mechanisms, there really is no way to control that credit creation. The only way the Federal Reserve can influence credit creation is by raising or lowering short-term rates. With that said, we’re at the outer bound, at zero, and what we’re finding is that demand for money is not increasing as the cost of money goes to zero — which is not unlike what we saw in Japan. What is happening, however, as ever when the cost of money stays this low, is that speculators are inclined to speculate because the cost of speculation on leverage is negligible.

The reason why, in Lapolla’s opinion, the Fed has failed in generating systemic inflation (and why the Fed will keep coming back, and doing the same wrong things over and over until everything finally breaks)

The reason [we don’t have systemic inflation] is that the labor markets are fractured. So, at the end of the day, what we’re having now is an asset inflation again, an echo. We’re not seeing the seeds or leading edge of wage/price inflation, the true driver of damaging systemic inflation. Asset inflation resolves itself in one way, and one way only, and that’s through asset deflation. So we have ongoing asset deflation in the residential real estate market. We have ongoing asset deflation in the commercial real estate market and we will ultimately have asset deflation across China and Asia.

On what would happen to the global economy if the dollar were to collapse versus the euro and commodities:

Global deflation and depression are what would happen.

On what self-cannibalizing HFT algorithms means for volume and for the markets in general.

Doesn’t it necessarily imply that there must be real inefficiencies in pricing on the table, for long-term investors, if everyone is totally focused on the short term? So, suggesting that “the game is over” has implications across the board. It has implications in terms of the way asset allocators think about investing, the way their money managers think about deploying capital, and ultimately about the way corporate managers think about deploying shareholder capital. We in effect are in this very awkward “teenage” stage where we’ve just had this fracturing shock, the credit crash, the exposing of all the financial hubris and misallocation of capital. We haven’t even moved to credibly addressing those issues in Europe and we’re still holding onto the notion that the emerging markets — which are just getting their first taste of capitalism on the back of reckless credit expansion and speculation — can somehow become the engine that overwhelms the massive deleveraging of the developed world. It’s a preposterous notion. I’m not being fatalistic. This is the way history moves. In 30 years, it will be clear to people, looking back, that this is the final chapter of the old story in which finance, financiers, leverage and short-term trading ruled the world.

On what the “sequel” is:

We’re moving towards something that, by definition, is going to have to address the real structural issues — in the U.S., fractured labor markets, still-excessive credit and unsupportable levels of debt tied to homes, a rising propensity to save, bleak expectations for wages and investment returns. From our vantage point, it’s only a question of timing. But it’s entirely possible that there won’t be an asymmetrically positive outcome for the globe. “Growth” is not a fait accompli. In fact, there can and probably should be periods, lengthy periods, of virtually no growth; of consolidation and pruning. So we would reject the notion that growth necessarily has to happen. Very marginal, just population-type, growth could in fact be the order of the day, and that implies a re-pricing of risk capital across the board.

Lastly, his investment advice:

Those who are bit more speculative, we’re encouraging to pick a spot where they will buy the U.S. long bond, if not zeros on the U.S. long bond, as rates start to move closer to 5%. It’s likely to have very high, equity-type returns, in short bursts.